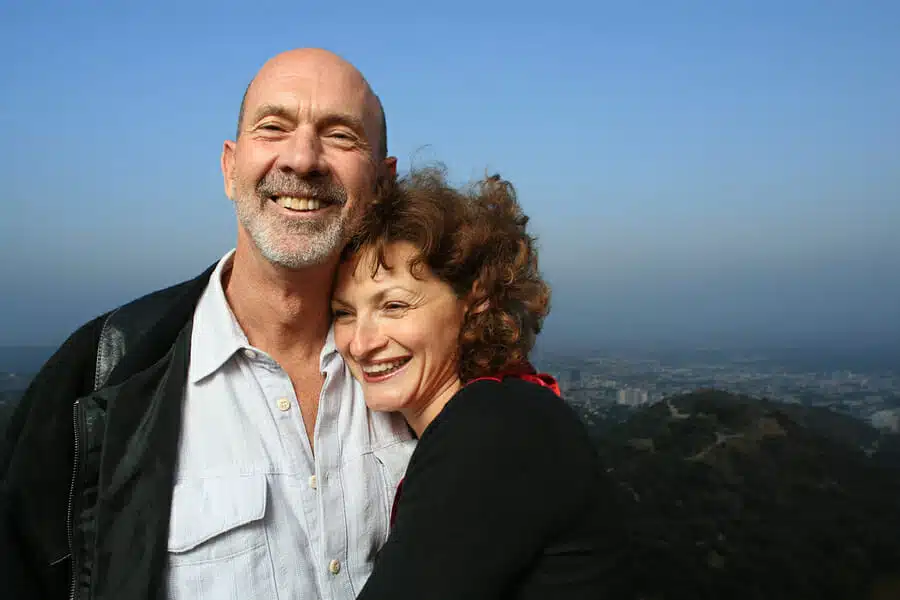

How To Make Retirement Years Happier For Your Parents

While we are all preoccupied with life, career and family, the retirement of parents can come quietly and faster-than-expected. This means it’s more important than ever to find our how to make retirement years happier for them.

As we talk about planning the possibility of parents’ retirement, we end up throwing some tough questions on how to plan the pool of finances in a better way.

Not to forget, your parents toiled hard to put you through school and college along with a full-access to summer camps, cricket coachings, dance lessons and all your extracurriculars.

They poured in all their money to give you the best of both worlds only to find that their retirement money doesn’t add up to much.

Your parents ended their working funds to give you comfortable living and it’s now time for you to look after them.

Are they saving enough? Have they already bought an adequate health insurance policy? Is it that their documents are ready or do they still need some rearranging?

Here are a few steps that you can take to ensure that your parents have a more secure and happier future.

Share their burden

In India, parents take huge loans to pay off for their kids higher studies. According to an HSBC survey, it is noticed that approximately 44% of retirees who fail to save enough is because of their continued financial help to their children.

Especially for children who opt to study abroad or choose higher studies like MBA and MS, the loan prices sky-rocket and parents lay under the burden of repaying the expense of giving class education.

It’s time that children take charge as you must not put the entire burden funding higher studies on your parents, instead, you should pitch-in by working part-time and also lay-off the principal amount once you land a full-time job.

Similarly, instead of having your parents shell out lakhs and lakhs of money for your wedding, come to a common ground and contribute with your to-be partner towards the total expense.

By doing this, you will allow your parents an opportunity to save more for their retirement.

Change your approach

The next step leading to happier retirement years of your parents is to ascertain if the pool of funds they have saved is enough to last them the rest of their retired years or are the funds moderate to cover some of their expenses only for a limited time period.

The most immediate and genuine way to figure this out is by measuring the income which will come in through the money from investments. It will help you determine if their post-retirement costs can be adequately covered or if there is a shortfall.

If your calculations do not meet your existing corpus, then you need to look for ways to shore up their savings.

In case they still have 4-5 years to go for their retirement, then you can have a conversation and convince them to invest in equities.

Get them a health cover

While a retirement gift for parents is always appreciated, after all, they’re officially off the work clock, getting them covered is the best way to ensure that they are protected.

Given the sharp rise in health costs (15-20% a year), without a cover, their savings are going to take a big hit rapidly. If you’re thinking that the employer-provided health cover is sufficient, then you’re wrong.

Even if you claim the offer, it still comes with a co-payment clause where you’ll be asked to bear a certain percentage of the expenses. So, include them in a family floater policy as soon as possible.

Unlock the value of the house

If you see that the after retirement financial position of your parents is not safe-sounding, then you might have to explore some uncomfortable options like downsizing the living arrangement(housing).

You can plan on moving into a smaller, more affordable property which will cut down on the living cost.

The other option can be reverse mortgage your house, where your parents will continue to receive a promised sum from a lender against the property which would imply that your parents will no longer be able to bequeath the property to you.

Get all the documents in order

Why this last step is about documentation, you ask? It’s because the absence of proper documentation in the case of loss of a spouse can lead to unnecessary problems and leave the other half vulnerable to tend to.

As well-read children, make sure that you see to it that both, your father and mother are well documented and financially protected in the event of one’s death.

You need to be cautious to see that the assets are not held in a single name and are not without any nomination.

We would suggest that it’s wholly best to have a Will in place which will go a long way in simplifying life for the legal heirs.

One thought on “How To Make Retirement Years Happier For Your Parents”